Competition or Collaboration for a Greener Economy? – Part 1

Should companies be allowed to 'collude' to reach net zero targets or other green economy goals? Are sustainability goals in tension with antitrust statutes? Do institutional investors, pursuing ESG goals collectively, violate antitrust law?

These are the questions at the heart of a new debate that is getting increasingly heated. Take, for example, fashion houses who have built entire businesses on "fast fashion" – throw away clothes that often end up in landfills. Should these companies be allowed to coordinate on limiting their apparel production to reduce waste, when it would otherwise be viewed as cartel-style market manipulation that may increase consumer prices? What about industry alliances like CEFLEX which brings together 180 companies and organizations in the EU to collaborate on designing solutions for flexible, circular packaging? What kind of information sharing, joint investments or ventures, or standard-setting is ok without falling afoul of antitrust laws?

Competition regulators are in a tough position – many firms claim that they need antitrust exemptions in order to coordinate on human rights or environmental goals. But giving companies exemptions from anti-cartel laws, as Austria did last year, also risks watering down an already under-enforced area of law which has had devastating social costs as industries concentrated to unprecedented levels in recent decades.

This conversation is well underway in Europe, the UK, and Canada (the US is somewhat behind its peers) about the role that competition policy will play in sustainability and "green economy" initiatives. (Note: I refer to competition and antitrust policy interchangably, as competition policy is the word used in Canada and the EU whereas antitrust is predominantly a US term).

Regulators now must weigh the potential trade-offs between stakeholders (like the environment, consumers, and companies) and what should be prioritized under the law. They are revisiting historic (and often narrow) interpretations of antitrust laws, and asking whether low consumer prices and market competition should remain the primary goals of competition policy, or whether these goals need to expand or be more flexible in light of current market realities.

I spoke on these themes last week at the Competition and Green Growth Summit hosted by Canada's competition regulator, the Competition Bureau.

Defining the "Green" Economy

More than one-third (702) of the world’s largest publicly traded companies now have net zero targets, and net zero pledges now cover 91% of the global GDP (including commitments from national governments).

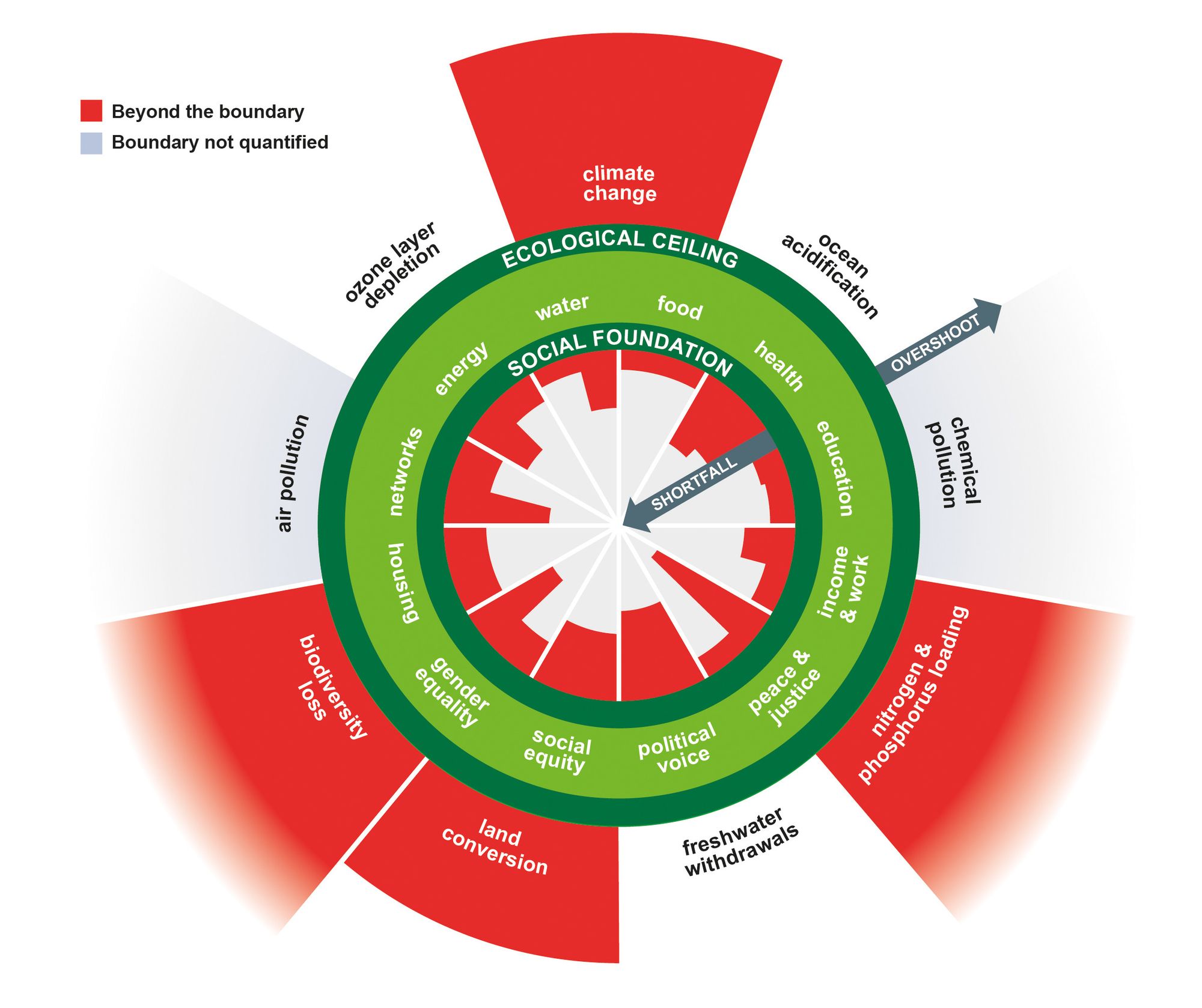

But when we talk about the "green" economy, we're not just talking about climate change and carbon emissions . We’re talking about not exceeding planetary boundaries in a number of areas including: biodiversity thresholds, freshwater withdrawal, air and chemical pollution levels, and others that Kate Raworth so elegantly visualized in Doughnut Economics (below). *Caveat, there is a very lively debate between green growth and degrowth approaches to economic resiliency, but we won't get into that today.

So when we think about the "green" economy, it is a vast space of many co-evolving markets and technologies across different sectors. Some obvious ones are: energy, utilities, mining, and as well as agriculture, textiles, consumer goods, technology and so on. It’s worth noting that in the US, Canada (and globally in many instances), the legacy forms of these industries are already highly concentrated.

Also, that the number of companies responsible for certain environmental concerns is quite small:

- 20 companies are responsible for most single use plastic waste

- 20 fossil fuel companies can be directly linked to more than one-third of all greenhouse gas emissions since 1965

- Just 10 financial actors stand in the way of slowing climate change, a new study found — a mix of investment advisors, governments, and sovereign wealth funds own 49.5 percent of the emissions potential from the 200 largest fossil fuel firms. The top 5 were: Blackrock, Vanguard, the Government of India, State Street and the Kingdom of Saudi Arabia.

Therefore, competition policy, concentrated industries and their financiers, and environmental concerns go hand in hand. This intersection is not a new reality, but only a new conversation.

Status quo vs. reformers

Broadly, there are two main debates happening on this issue:

- The Philosophical debate – whether sustainability should play a role in antitrust law and policy

- The Technical debate – what role sustainability can play in antitrust

There is a small, but loud cadre of pundits and institutions who are intent on eddying the conversation endlessly in the first category. Many of them argue that sustainability concerns have no place in competition policy. They tend to also argue that everything is perfectly fine as is – no need for significant changes to our antitrust laws or enforcement approach. They use phrases like "hipster antitrust" to disparage anyone who disagrees with their views. Lawyers and economists working for large corporate law firms, and who defend monopolists in court, tend to use this approach.

I think of these folks as the "go slow, status quo" crowd. Institutions like the conservative think tank, the C.D. Howe Institute in Canada, write extensively along these lines. (Relevant aside: a recent Logic article uncovered that C.D. Howe and other Canadian think tanks are funded by Amazon. The sprawling company is hopeful that its shadowy political influence campaign can kill desperately needed changes to Canada's competition law, which are expected in 2023).

The second camp – those asking what role competition policy can play in supporting (or hindering) sustainability goals – recognizes that competition policy has already had significant environmental impacts. Both our understanding of its aims, and its enforcement (or lack thereof), affect the shape of markets. We have failed to account for these environmental impacts historically because economists haven't had many incentives for quantifying them.

We now know that there are many externalities of concentrated industries, including the erosion of democracy, rising inequality, lower growth and innovation, contributions to racial and gender imbalances, and others. Competition policy’s lack of account for environmental outcomes, and its under-enforcement for four decades – has already had blistering environmental effects.

This doesn’t mean competition policy can necessarily solve environmental issues, or is the right tool for addressing them unilaterally, but it can play a part alongside other regulatory and legislative reforms.

For example, some presenters at the conference suggested that when evaluating the non-price effects of mergers, antitrust enforcers could take environmental effects into account when considering the quality of a product or service. This might be one way to include these considerations without fundamentally altering the text of the law in various jurisdictions.

Here are a few examples where new competition concerns are emerging in various "green" sectors:

ENERGY AND CARBON

Carbon capture utilization and storage (CCUS) and electrification get most of the attention, but what about software? The incumbent big tech firms like (Salesforce, Microsoft, and Google) are racing to be the sustainability tech software platform of choice for companies to manage green reporting tools, carbon accounting, supply chain management software, etc.

Last week, Salesforce put a big stake in the ground by announcing its Net Zero Marketplace – an integrated platform where companies can buy carbon credits that are vetted by the company. The Marketplace integrates with Net Zero Cloud, Salesforce’s carbon accounting solution, demonstrating how the company wants to become the de facto broker-dealer of this global market (it's unclear whether companies would be able to sell carbon credits on the platform in the future). This move also demonstrates how financialization has turned companies into asset managers, as companies turn to trading financial products for revenue. It raises new gatekeeping questions for this industry, one that both competition regulators and securities regulators will need to consider.

*If any readers are carbon market experts, I'd love to hear your thoughts.

UTILITIES

A coalition of more than 200+ rooftop solar and distributed energy companies petitioned the FTC petition to investigate electric utilities companies (to conduct what's called a "6(b)" or "market study") to look into the monopoly power of incumbent utilities companies and how they are suppressing the retrofitting of residential and commercial real estate. They argue that abusive utility practices are “leading to increased electricity rates, obstruction of clean energy competitors in the face of climate change, and utility interference in democratic processes.”

AGRICULTURE

Regenerative agriculture is a major buzzword these days, but there are already high degrees of concentration in agriculture, seed stock, industrial farming equipment, meatpacking, etc. This means that many innovations might otherwise reach the market, may never see the light of day. As one example, one entrepreneur I spoke to in the US who provides direct to consumer ethical, environmentally friendly meat production could not get slaughterhouse space due to the big 4 meatpackers, and was forced to move the majority of his business to Australia.

These and many other examples are raising new (and old) issues for competition regulators. We’ve had 40 years of one ideological approach to competition policy – the 'consumer welfare standard' – which has traditionally ignored any other 'externalities' of market power aside from low consumer prices and efficiency. This approach is now at the point of diminishing returns. The status quo is no longer viable.

In Part II of this post, I'll talk about a systems-thinking way to anazlye collaboration and competition, based on lessons from evolutionary biology, discuss the ongoing ESG fiasco in the US (with conservative AGs weaponizing antitrust against firms like Blackrock), and include some recommendations for competition policy enforcers along these lines.

PS my last post had deliverability issues (sorry) so you can access it here:

When Markets Fail.