A Massive, Hidden Force Shaping the Economy: Serial Acquisitions (aka Roll-ups)

It's new report release day!

The Roll-up Economy: The Business of Consolidating Industries with Serial Acquisitions, co-authored by me and colleagues at the American Economic Liberties Project, Krista Brown and Erik Peinert, and collaborator, Taylor Sekhon, is out today.

Here is the report (including an executive summary) and the press release. And an epic tweet thread and Medium summary about the paper from the fantastic journalist and author, Cory Doctorow.

**For Canadians following my work, I also co-authored a piece in Policy Options with Robin Shaban on how this trend is affecting Canada, and the legal tools we have to address it within our current competition framework.

The Roll-up Economy

Mega mergers like Microsoft/Activision and Meta/Within get most of the media attention, but there is a hidden trend re-shaping the economy that falls outside of regulatory scrutiny and the limelight: serial acquisitions, also known as "roll-ups" (which contain some of the same deceptive marketing as Fruit Roll-Ups, a personal childhood favorite of mine).

Serial acquisitions refers to an intentional business strategy that seeks to consolidate fragmented industries by buying up a number of small companies in a relatively short period of time. While private equity is particularly well-known for employing roll-ups, this strategy is now being used by public companies and startups.

Whether it is magic mushrooms, youth addiction treatment centers, mobile home parks, nursing homes, comedy clubs, ad agencies, water bottles, local newspapers, or health care practices, many local businesses we normally think of as independent are being swept up in serial acquisition sprees via corporate consolidators.

If you want to read something depressing, read this excellent Prospect piece about Peter Thiel rolling-up the psychedelic mushrooms space. The Prospect actually has a whole series on rollups which is really worth digging into.

Roll-ups occur when an investor, such as a private equity firm, buys up companies in the same market and merges them together. Roll-up mergers combine multiple small companies into a larger entity that is better positioned to enjoy economies of scale or to exercise market, pricing, or buyer power.

Let me tell you a story to illustrate how this is happening.

When researching for this report, I read about this trend of consolidation in healthcare with specialty medical practices (like radiologists, anesthesiologists, emergency room doctors, etc.) and even dentistry and veterinary practices. I love my local dentist in Seattle. She is professional, kind, and her office is welcoming and warm. I actually look forward to going. After learning that dentist's offices are particular targets of corporate consolidators, I asked her if she was still independent and owned her practice.

Thankfully, she said she did! However, she receives three flyers / week asking her to sell to a corporate buyer. Some of the flyers appear to come from other independent dentists wanting to grow their businesses, but she speculated that if she researched it, even these seemingly independent offers were also likely coming from the corporate consolidators.

Companies and investors can aggregate a lot of market power through serial acquisitions, and it happens outside of any regulatory oversight or even visibility. All around the world, competition authorities have issued reporting thresholds for which mergers need to be reported to their agencies. In the US, these are called the Hart-Scott-Rodino or HSR guidelines, which are currently $101 million. Meaning, if a merger or acquisition is valued less than this, companies have carte blanche permission to go ahead.

To give a sense of the potential scale of this trend, in 2021, there were 21,994 total merger transactions in the United States, yet under 20% — only 4,130 — were reported to the FTC. Similarly, in 2020, there was a total of 16,723 transactions, and only 1,637 — under 10% — were reported.

Public tech companies pursuing serial acquisitions

The FTC noted this problem in a September 2021 report showing that from 2010 to 2019 Alphabet, Amazon, Apple, Microsoft, and Facebook (now Meta) acquired 616 companies in a spree of acquisitions. Only 94 (or about 15%) of those acquisitions were filed with the agency. The remaining acquisitions fell below the HSR thresholds ($92 million at the time of the study) and were therefore conducted without direct antitrust oversight.

FTC Commissioner Rebecca Slaughter put it this way: "I think of serial acquisitions as a Pac-Man strategy. Each individual merger viewed independently may not seem to have significant impact. But the collective impact of hundreds of smaller acquisitions, can lead to a monopolistic behavior."

US enforcers at the Department of Justice and the Federal Trade Commission are taking notice, and have mentioned roll-ups as a point of focus. Assistant Attorney General of Antitrust at the DOJ, Jonathan Kanter, spoke about roll-ups at a recent interview at the Federalist Society – PE section starts at 1:29:57 when Rick Rule – the former head of the Antitrust Division under President Reagan – asks about how PE will show up in the new merger guidelines that are anticipated to be released sometime early next year. Lina Khan, Chairperson of the Federal Trade Commission, also mentioned them during a recent Wall Street Journal interview (minute 24).

The Staggering Growth of Private Equity

The growth of the PE industry — measured in both number and size of funds — is staggering. Over the past decade, more than 4,000 US private equity firms have raised over $2 trillion, and this is only for buyout strategies. These funds range from individuals who are funded to buy and operate a single company, to large Wall Street firms — like KKR and Apollo — managing funds with over $100B in assets. There are now more than twice the number of private equity-owned companies as there are public companies — more than 8,000 — in the US.

A majority of private equity deals are pursuing a strategy of serial acquisitions. There is hardly an industry private equity has not tried to roll-up using add-on acquisitions: comedy clubs, ad agencies, water bottles, local newspapers, and healthcare providers like hospitals, ERs, and nursing homes.

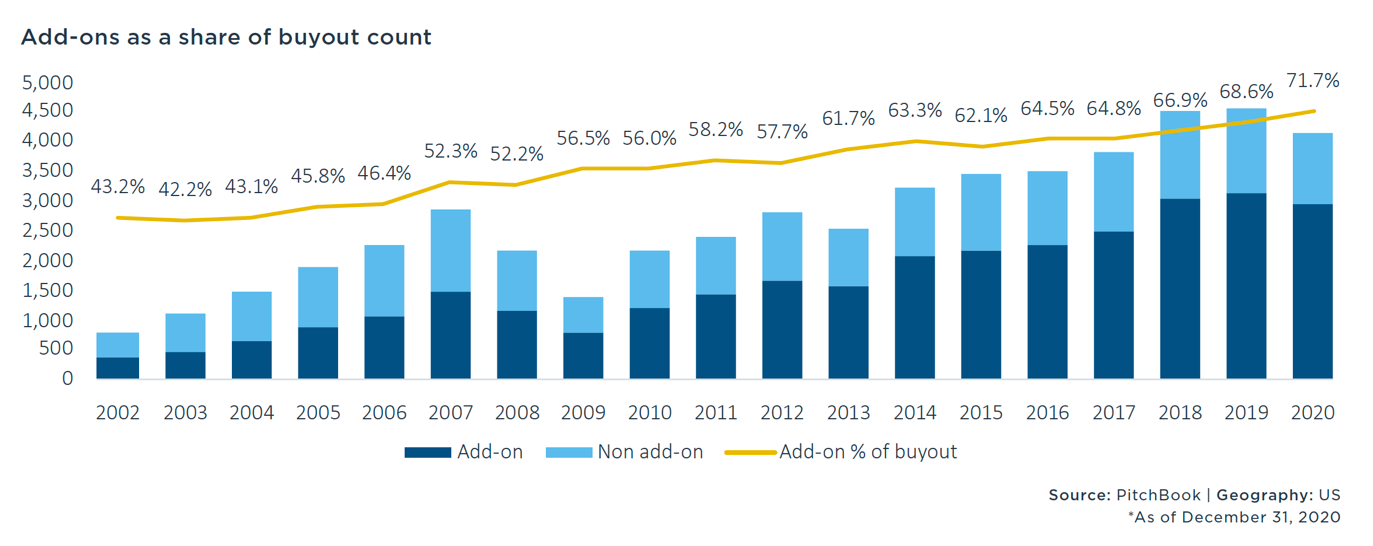

In 2020, 71.1% of PE deals in the US were add-ons, which are when a PE firm uses a company it already owns to do acquisitions, instead of investing in many smaller companies directly through separate investments. Add-on acquisitions help the private equity firm build a larger company that it can eventually re-sell at a higher price, often because of newly acquired market power. More than 70% of private equity transactions are add-ons. When a number of add-on acquisitions are made in one industry, it is referred to as a “roll-up” because they are meant to “roll-up” or consolidate an industry.

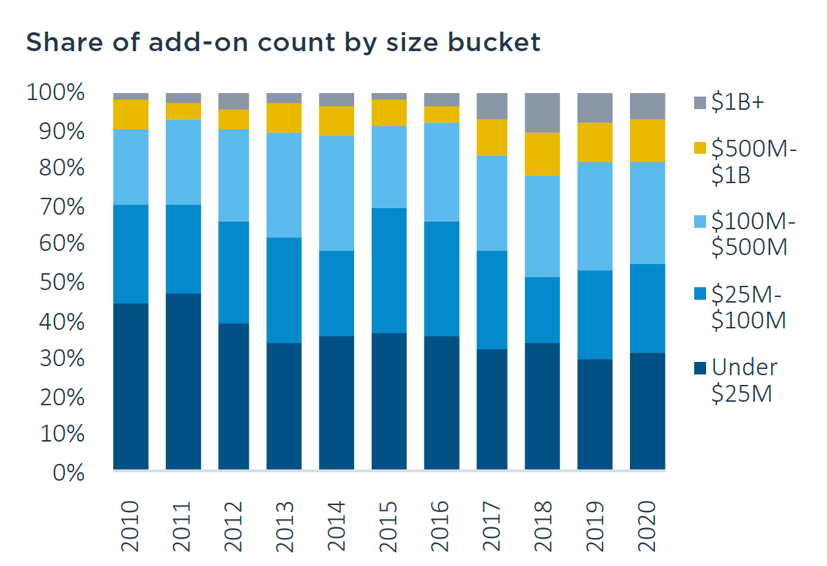

“Add-ons have steadily increased in importance as a PE strategy over the past two decades” according to Pitchbook. Many of these add-on acquisitions fall below the HSR reporting threshold, with the median buyout size now around $70 million. The chart below shows that over 50% of add-ons are below $100 million.

This means that regulators are effectively flying blind.

It's not just private equity, however, the report details a few case studies, including the public eyewear company ElissorLuxxotica which has a monopoly, largely achieved through numerous mergers over time. And we also discuss how, increasingly, startups are raising venture capital to pursue consolidation plays. Like the startup, Thrasio, which rolls up Amazon third-party sellers.

The Good News: We have the tools

Thankfully, there are laws and legislative text to deal with this problem, as well as some case precedent.

Section 7 of the Clayton Antitrust Act sought to prohibit such serial acquisitions with a standard for “incipient monopolization.” It stated that no firm can acquire the stock or assets of another “where the effect of such acquisition may be to substantially lessen competition between the corporation whose stock is so acquired and the corporation making the acquisition.”

When ruling to block a banking merger in 1963, the Supreme Court stated, “A fundamental purpose of amending § 7 was to arrest the trend toward concentration, the tendency of monopoly, before the consumer’s alternatives disappeared through merger.”

Some serial mergers increase efficiency and are a lower-risk way for businesses to expand and grow. BUT another key motivator is aggregating market power to raise prices or extract concessions from stakeholders like workers or suppliers using stronger buyer power.

We make a number of recommendations for legislative and regulatory changes to antitrust in the US, which you'll have to read in the report.

Download the report, and the executive summary, here.