The Wizard of Oz Money Monopoly

What do you call a small cadre of unelected individuals who unilaterally – and secretly – make consequential decisions radically affecting the US economy? The Federal Reserve.

Many Americans don't know much about our central bank, its function, and its founding; and yet it looms large as perhaps the most influential actor in how our economy – and financial markets – function. Some also consider it one of the primary culprits of widening inequality in recent years. I'm not a Fed basher, per se, and I think the Fed exists in a kind of paradox: It both has tremendous power AND is also constrained and somewhat powerless to influence the economy in a linear fashion, even though it is supposed to. Regardless of what you believe about the Fed's powers, it's safe to say we're well beyond the point of diminishing returns on the approach that central banks have taken in recent decades. It's time to revisit both their goals and tools.

Earlier this week, I had the privilege of interviewing Chris Leonard – author of The Meat Racket and the New York Times bestseller, Kochland – about his latest book, The Lords of Easy Money: How the Federal Reserve Broke the American Economy. You can watch the reply of my interview with Chris below, and I'm going to summarize a few of my key takeaways from the book in this post.

Side note: This interview is part of an Economic Liberties series called "Thinking Big" where we feature authors who help expand our thinking about important topics in economic policy-making and corporate power. So far we've hosted Rana Foroohar, Kathryn Judge, Peter Goodman from the New York Times, Brandi Collins-Dexter, and Elizabeth Popp Berman. Next up on December 13 is Cory Doctorow on his book with Rebecca Giblin, Chokepoint Capitalism. Sign up here.

First off, I can't recommend Chris' book enough – I found it informative, shocking, and highly readable (considering monetary policy doesn't exactly seem fertile grounds for engaging storytelling, but is actually very fascinating and deeply human!).

As quick background, the Fed was created in 1913 because banks were constantly failing due to panics and runs on their reserves. This was a bad situation for everyone. Prior to the creation of the Fed, it was effectively up to J.P. Morgan to personally call his friends and accumulate enough money to keep banks liquid in the event of a bank run. For this reason, the creation of the Fed was favored by progressive groups who thought it was a much better, and more fair, system for handling economic shocks. It definitely was.

The Fed's primary purpose is to manage money and credit systems so as to influence stable prices and employment (which is why they ostensibly target inflation and unemployment). They are also meant to ensure the stability of the financial system overall and to regulate banks and financial institutions.

Even though the Fed was an improvement on the wild west of banking at the turn of the 19th century, as Leonard states, “a big wall went up around the decision-making on money” with its creation.

Private power setting public policy

One of the pervasive themes of Leonard's book, which I've written about before (here and here), is that economic policy-making and market norms are increasingly being made through private, non-democratic channels. As democratic pathways like Congress have sputtered and divided, more policymaking has moved to places like the Fed. In many ways, monetary policy has trumped fiscal policy in its reach and influence in recent years.

“The politics of money wasn’t just a technical affair involving smart people who solved equations. It was a government action that imposed a public policy regime, affecting everyone. ...The Fed became the central driver of American economic policy making.” – Chris Leonard

Nearly every day we hear – and may feel – that democracy is at stake, but money and the monetary system in the US has never been democratic. Because of this, crypto narratives about democratizing money production and decentralizing it became incredibly popular among libertarians. But despite their lofty aims (or perhaps just their well-funded marketing campaigns), the majority of crypto projects have proven just as bad, if not worse.

As Sam Bankman-Fried's FTX has spectacularly exploded the last two weeks, it demonstrates the big irony at the center of our current iteration of crypto – the crypto universe has become highly concentrated and centralized, with only a few major players acting as central nodes in the network. This makes the system very fragile. As the WSJ article, "Crypto’s FTX Moment Shows Danger of Centralized Finance With No Central Bank" so aptly puts it:

"Having compressed most of the mistakes made by finance over the centuries into just over a decade, crypto speculators may finally be discovering the fundamental flaw of trying to build an alternative to government-backed finance: no government backing."

Despite crypto's desire to disrupt and challenge the centralized production of money, those dreams have yet to materialize in any significant fashion, while the reach of the Fed grows ever stronger.

Money to the Moon

For this reason, speaking to Chris this week felt timely for a number of reasons. The Lords of Easy Money focuses on the post 2008 financial crisis, when the Fed began expanding its role significantly. One of the primary ways they did this was through quantitative easing (QE) – purchasing a large number of securities from banks in exchange for handing over cash. In this way, they pumped huge amounts of money into the financial system by depositing it at major Wall Street banks, known as primary dealers. The philosophy was a form of trickle-down finance: 1) give the banks money, 2) they'll make loans to consumers 3) consumers will purchase stuff, 4) this will boost growth.

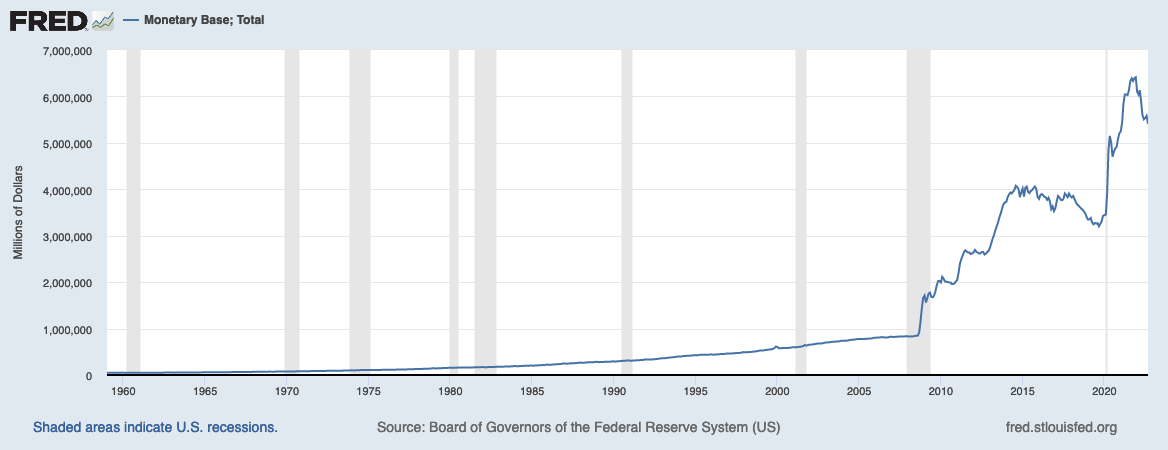

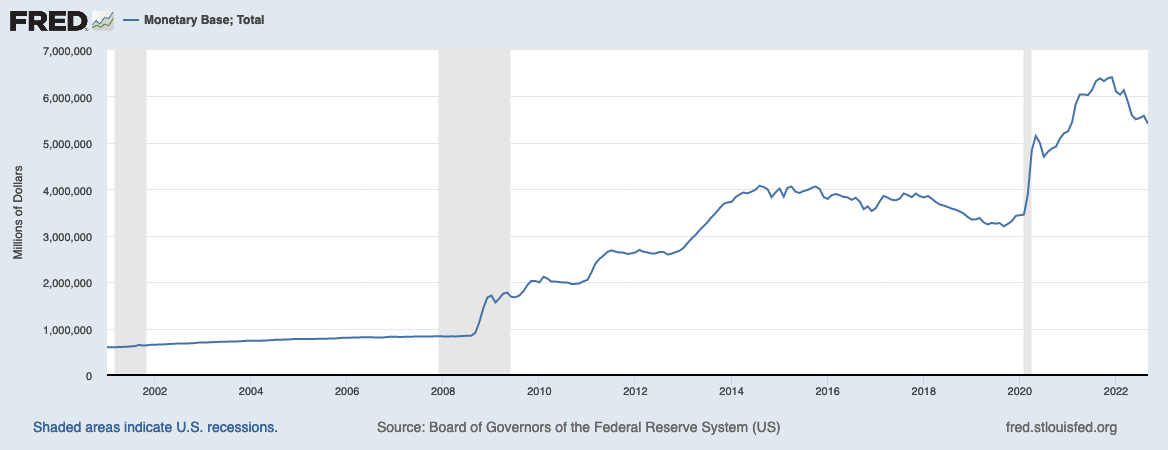

Below you can see the expansion of the monetary base from quantitative easing (how much money the Fed printed and sent sloshing around in the system). The monetary base increases dramatically from 2008 to 2015 and again during Covid. Between 2008-2010 the Fed printed $1.2 trillion (one hundred year’s worth of money in a little over one year)!

Where did all the money go?

Inequality and Doom Loops

The Fed coupled quantitative easing with setting interest rates at zero or near zero for many years (known as zero interest rate policy, or ZIRP). This meant that money and debt were cheap, and it led to asset bubbles, particularly in public equities (the S&P 500) and housing. It also helped the private equity industry grow to unparalleled heights. Today, private equity controls double the amount of companies as are publicly traded in the US, and the industry’s AUM grew to an all-time high of $6.3 trillion in 2021.

Leonard helpfully distinguishes between asset inflation and price inflation. In other words, milk at the grocery store wasn't getting more expensive, but housing, public equities, and other forms of market speculation increased at a rapid pace, inflating the price of assets that are mostly owned by rich people. In this way, the Fed is one of the primary culprits of inequality in recent years, as the assets of the wealthy soared in value, pricing everyone else out.

The crazy thing is that the Fed KNEW it was doing this. Fed governors who opposed QE told Ben Bernanke (the Fed Chairman from 2006 to 2014 who architected this plan) that all this money would have 'allocative effects.' This meant that QE would pick winners and losers in the economy by inflating the value of assets, mostly of the already wealthy. Despite receiving significant pushback internally, Bernanke pressed on with his ZIRP and QE plans.

One reason for this was that the Fed often made these decisions based off of speculative and marginal economic gains in the short-term (like lowering national unemployment by half a percentage point), in exchange for catastrophic economic consequences down the road. And once markets got used to cheap money and easy debt, it was nearly impossible to take away the punchbowl from the financial party.

This created a kind of doom loop – a feedback loop or negative spiral where every attempt to correct past actions actually made the situation worse. The Fed put itself into a bind, forever doomed to repeat and augment its previous actions in a way that only continued worsening long-term outcomes. In plain language: kicking the can ever further down the road for someone else to deal with. This is still the case today.

Here's one of the most consistent dissenters who Leonard covers extensively in the book, Thomas Hoenig – President of the Kansas City Fed, trying to warn Bernanke of this doom loop:

“The financial and economic shocks we’ve experienced did not just come out of nowhere. They followed years of low interest rates, high and increasing leverage, and overly lax financial supervision, as prescribed by both Democratic and Republican administrations. The continued use of zero-interest rate will only add risk to the longer-run outlook.” – Hoenig, August 2010

These warnings were never heeded. And extraordinarily, Bernanke left the Fed in 2014 as a hero. He even recently was awarded a Nobel Prize in Economics (which isn't actually a thing...it's an unaffiliated award given by the Bank of Sweden – another central bank!). Interestingly, here's Bernanke in 2018 denying that QE created inequality, arguing that it created jobs.

Now, despite having a "Nobel Prize" in economics, apparently Bernanke hasn't learned that jobs and assets (labor and capital) don't quite have the same earning potential. And although Bernanke claims there are no academic papers showing that QE caused inequality, here's one and another.

Economists as Soothsayers

The Fed put near religious faith in speculative economic models built by PhDs just out of their postdoc program. Most of these models turned out to be wildly wrong. The Fed succumbed to a broader trend which has infected many institutions since the 1980s – giving economists entirely too much credence, and positioning economics as a neutral, scientific discipline. It was an incredibly econometric way of viewing the world – one that was hopelessly out of touch with reality.

To illustrate this point, Leonard shares this incredible story in the book. One Republican Fed president, Richard Fisher, shared a conversation he had with the CFO of Texas Instruments. The company – like all major companies – had access to a lot of cheap debt that the Fed's policies had created. The CFO explicitly said that he wouldn't use the financing for things like re-investing in infrastructure, hiring, employee training or other ways of generating innovation. Rather, he would use it for stock buybacks (a way to artificially inflate the company's stock price, which was illegal prior to 1982). After listening to Fisher's story, Bernanke replied:

“I want to urge you not to overweight the macroeconomic opinions of private-sector people who are not trained in economics.”

This was the kind of hubristic and off-the-wall thinking that dominated the Fed.

System Risk

Fast forward to 2019 and 2020, when some of the risks that had been building up in the system materialized in weird ways in financial markets. In 2019 an important but obscure part of financial markets, known as the repo markets seized up. The repo market is when banks lend to each other overnight so they have enough money in their accounts to meet regulatory requirements. The Fed intervened to stop a meltdown.

Then in March 2020, a full-scale global financial collapse much worse than the 2008 financial crisis was about to ensue as Covid risk shocked markets. The Fed stepped in with the most unprecedented expansion of its power in history, a much bigger bailout than in 2008. You'll have to read the book for all the details, but in 2020, the Fed created roughly $3 trillion in 90 days — as much as 300 years of money creation prior to 2008. It also did something it had never done before: bought corporate debt directly using special purpose vehicles (and taxpayer money), and initiated the Main Street Lending Program (which bypassed the typical Wall Street firms it usually deals with). It also got rid of reserve requirements, meaning banks did not have to keep a set amount of cash handy in case customers want to retrieve it.

While the actions of the Fed were arguably necessary to stave off a horrible economic crisis, it was more evidence of the doom loop and the "too big to fail" system of finance that exists today. Risks keep building up, and every time they're about to materialize, the Fed has to intervene. However, the Fed's recent actions to increase interest rates to combat inflation may bring some of those risks home to roost.

How does this end?

No one, of course, knows. Least of all me. But I hope to explore some alternative policies proposed by other groups in a future newsletter. Would love suggestions of reforms you've seen that you like, or think are viable. The Bitcoiners are still trying to convince me that Bitcoin will save the world – I'm in wait and see mode.

In the meantime, here are two interesting papers on alternative approaches:

1) The People’s Ledger: How to Democratize Money and Finance the Economy by Saule Omarova

2) Central banking for All: a modest case for radical reform by Nesta

The Wizard of Oz Paradox

Ultimately, the great paradox of the Fed is that:

• it is incredibly powerful, and its market interventions have ripple effects we don't truly understand; AND

• it is much less powerful in its ability to influence the economy in a linear, targeted way than we'd like to believe.

Markets, money, and economic systems are complex systems that can't be controlled with a series of blunt levers. In this way, the Fed is like the Wizard of Oz – frantically pushing buttons behind the curtain, but ultimately left saying "I'm just a very bad wizard."

If you'd like to better understand this paradoxical institution, The Lords of Easy Money is a great place to start. And you can watch my interview with Chris here.