What is life? What is economic value?

Hello to my new subscribers — thanks for being here. I recommend reading my introductory post: Welcome! What is Embodied Economics? if you haven't already. Please feel free to reach out anytime with questions or comments: hello@denisehearn.com (still working on adding a comment function to this blog).

Today's post tries to elucidate a simple assertion: similar to how scientists have no unified definition of life, economists (and policymakers and the rest of us) have no universal definition of economic value — economic 'value' is open to interpretation, manipulation, and fabrication. We'll explore this through three spheres of economic activity: products, companies, and financial instruments, and end by asking what 'hallmarks' of economic value might drive the global economy of the future.

Note: Much of what I learned about the centuries-long scientific inquiry into life came from Carl Zimmer's new book Life's Edge: The Search For What It Means To Be Alive, which I highly recommend. I also include quotes from scientists he interviewed in the book. Let's begin!

“Value is thus nothing inherent in goods, no property of them, nor an independent thing existing by itself. It is a judgment economizing [people] make about the importance of the goods at their disposal for the maintenance of their lives and well-being. Hence value does not exist outside the consciousness of [humans].” — Carl Menger, founder of the Austrian School of Economics, 1871 (quote changed to be gender-neutral, emphasis mine)

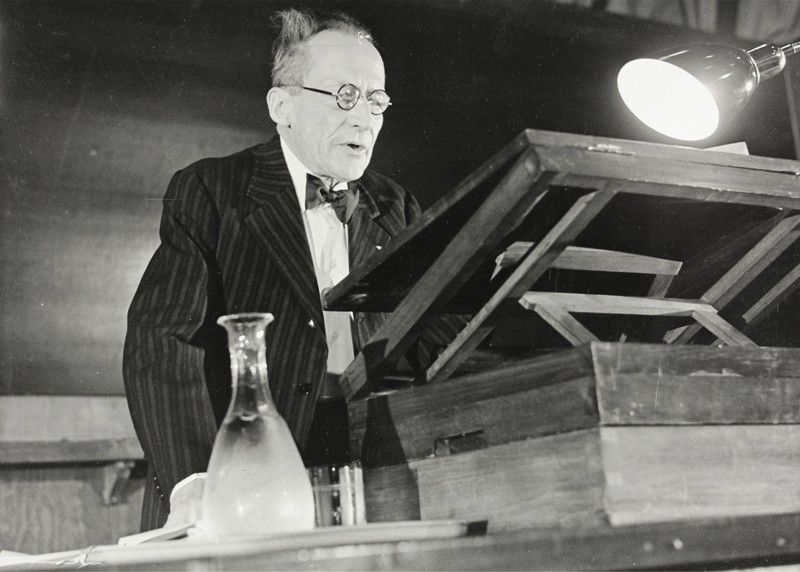

In 1943, the Austrian-Irish Nobel Prize-winning physicist, Erwin Schrödinger, delivered a series of popular lectures in Dublin to hundreds of listeners. “What is life?” Schrödinger asked, and his lectures were later compiled into a best-selling book of the same title. This deceivingly simple three word question had intrigued and baffled scientists for centuries before Schrödinger, and a question which remains unanswered today.

Defining the fundamental characteristics of life, forms not only the basis of biology, but also genetics, biochemistry, evolutionary history, and even astrobiology (the study of life in the universe). But despite its foundational importance, a singular answer remains elusive. Dozens of definitions have been proposed over the years, including this 1992 NASA attempt: “Life is a self-sustained chemical system capable of undergoing Darwinian evolution.” But some biological creatures defied or complicated this and other proposed definitions. Today, scientists are yet to reach consensus — no standardized, universal definition exists.

As Radu Popa, a microbiologist, has said: “This is intolerable for any science. You can take a science in which there are two or three definitions for one thing. But a science in which the most important object has no definition? That’s absolutely unacceptable. How are we going to discuss it if you believe that the definition of life has something to do with DNA, and I think it has something to do with dynamic systems? We cannot make artificial life because we cannot agree on what life is. We cannot find life on Mars because we cannot agree on what life represents.”

There are, as Zimmer calls them, hallmarks of life that seem consistent across most life forms: metabolism, information gathering, homeostasis, reproduction, and evolution; but some organisms defy these categories — red blood cells, viruses, tardigrades, and others. Ultimately, some argue, searching for a definition itself is futile. Carol Cleland, a philosopher, has advocated against finding a universal definition of life because it ignores the more fundamental question of what it means to be alive.

Similarly, when we begin to ask ‘what is economic value?’ it is surprisingly difficult to come up with a coherent answer. Just as there is a wide range of opinion regarding how to define life, our conception of economic value is also beholden to a range of opinions, philosophical judgments, and irrational human behaviors which defy easy explanation. Economists have proposed different "Theories of Value" — some tied to production or exchange — but, all of which rest on some invented philosophy about where profit and, ultimately, economic value come from. In other words, economic value is a notion we invented, and we can evolve it to better serve our needs today.

We'll look at three categories which represent economic value in our current system to draw out the subjectiveness of the concept: 1) products, 2) companies, 3) financial instruments.

Products: Veblen goods and the power of price

In traditional economic theory, a major determinant of economic value is price. You want this bread, or pair of earrings, or car. You then determine the relative value of that object and pay for it accordingly.

There are, of course, numerous instances where price demonstrates the extreme relativity of value. For example, take absurd luxury goods — like a $150,000 Louis Vuitton purse made of actual trash (above) or a $3.2 million diamond dog collar. In these instances, the price of the object is massively inflated against the value of the item’s utility. In a flood, famine, or apocalypse, trash purses will not be very useful.

But still, people buy them. And they buy them precisely because they are expensive. There is an economic term for this — items which become more desirable as their value increases are known as Veblen goods. This defies the simple supply and demand logic of price, often invoked by economic models. It’s not just scarcity that makes these items expensive, it’s the very fact that they are expensive status symbols that makes them expensive. Veblen goods can only exist in a society with complex relationships and social hierarchies — and for many similar goods, price may be more representative of power than of value.

We also know that price can be manipulated. Take price gouging by dominant firms which have outsize market power (or among colluding firms). Is insulin 5-10 times more economically valuable in the US than in other nations? Of course not, diabetics need the same drug treatment in Portugal or Singapore as anywhere else. But colluding US drug companies have conspired to artificially inflate the price of insulin over the last few decades, reaping enormous profits. Similar stories emerge across a number of industries.

According to several recent studies, price markups (the amount a company charges above its production cost) has dramatically increased in recent years, particularly in concentrated markets like airlines, banking, and healthcare. One study showed that in 1980, average markups were about 20 percent above marginal cost — today, they are above 60 percent.

So while the price of an item may be one indicator of economic value, it is not wholly representative and is often subjective. And in some cases, a product's price may more accurately represent the purchasing power of the buyer — or the market power of the seller company — than any kind of inherent value. Price is an insufficient proxy for value.

Companies: from tangible to intangible 'value'

When we try to measure the economic value of companies, the stock price, or market capitalization, is generally used (although there are many ways to try and calculate a company's value). While there are many reasons to question market capitalization as a metric, it is worth noting that the way we understand and measure a company's value has evolved significantly over time.

Companies have become increasingly financialized, meaning that they derive more economic ‘value’ by holding financial assets on their balance sheet than they do selling actual products or services to customers. A great example is Tesla making more money selling Bitcoin and carbon credits than cars earlier this year.

Financialization has coincided with the shift from tangible to intangible value that has occurred in recent decades. Intangibles are things like “goodwill” (the brand recognition and marketing value of Coke or Nike, as an example), and intellectual property and patents. Intellectual property is now the world’s most valuable asset, accounting for 84% of the total value of S&P 500 companies. And patent applications have more than doubled in the US over the last 20 years. Protecting IP and patents can be important, especially for new entrepreneurs, but increasingly the largest firms use patent filings to shore up their dominance and eliminate competition. This actually reduces innovation, while aggregating increasing profits to a smaller number of giant companies.

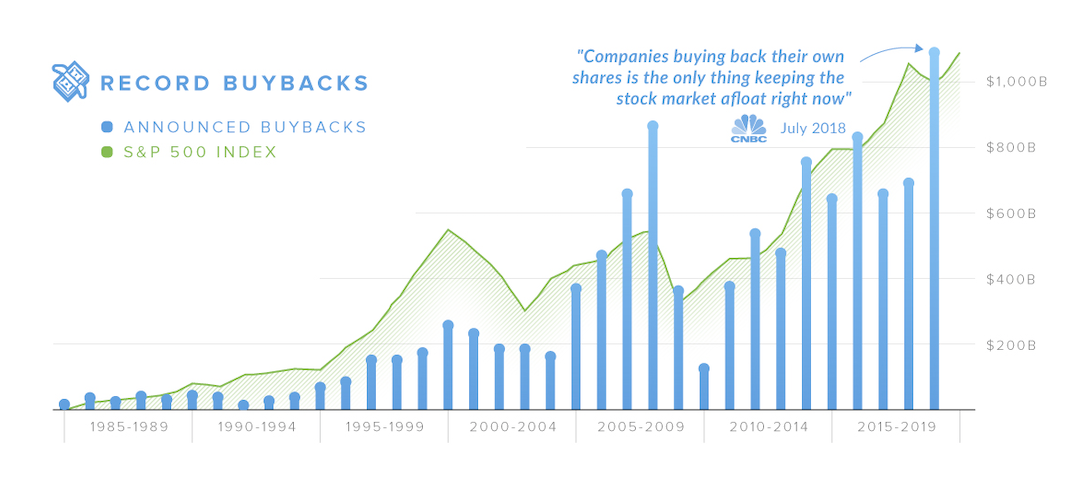

Another way companies have increased their market valuation is through share buybacks — when a company buys its shares back from the public, leaving fewer shares available and, therefore, increasing the value of those shares. In simple terms: it's a way for corporate executives to inflate a company's stock price without making any material changes to their business model, profitability, or productivity. Julian Krein speaks to this in a great American Affairs article, "At Apple, America’s largest company by market capitalization, operating income has barely changed in the last six years, yet its stock price has more than quadrupled, in large part due to $337 billion in buybacks." Some have called this "growthless asset-value maximization."

Buybacks have risen to meteoric heights in recent years, despite the fact that they used to be illegal before the early 1980s (cue B-roll of then President Reagan's deregulation campaign). You can see in the chart below how buybacks start rising in the 1990s and reach a fever pitch in 2007, right before the Great Financial Crisis. More recently, companies spent the majority of the 2017 Trump tax cuts — a then record-breaking total of over $806 billion in 2018 — on buybacks. And 2021 is projected to be an all-time record year, with companies perhaps surpassing $1 trillion in buybacks.

Taken together, the shift from tangible to intangible value, financialization, and the rise of stock buybacks, are significant because they demonstrate the evolving nature of how the value of companies is understood and measured. Companies are now more incentivized to simply manipulate their 'value' through accounting mechanisms like financial engineering (including offshore tax havens and shell companies) and stock buybacks — as opposed to providing quality goods and services to customers. For this reason, the entire notion of corporate value needs to be re-visited.

Financial instruments: synthetic life and synthetic value

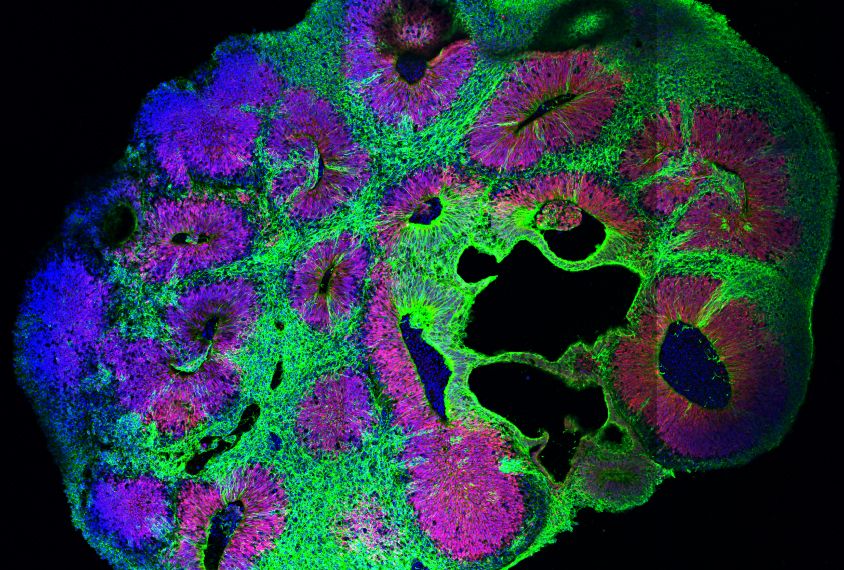

Returning for a moment to biological 'life': In 2013, scientists produced the first brain organoid (a synthetic "mini brain") that mimicked the 3D nature of our human brains. Organoids are built from stem cells which, after being nudged by scientists, can self-assemble into miniature brains, hearts, lungs and other organs by following their encoded evolutionary paths.

Brain organoids mimic the cerebral cortex and are a collection of cells that begin to act in collective manner. Organoids can stay alive for years at a time, and they have even flown to space! Today, organioids even produce brain waves. This has caused a crisis in scientific communities: can we measure consciousness on a scale? How might we value synthetic life?

This made me think of derivatives — synthetic financial instruments which are, at their simplest, bets on future outcomes. They derive value from betting on the value of an underlying asset either rising or falling in the future. Common derivatives are forwards, futures, options, or swaps, which are a derivation of an asset like a stock or bond. Derivatives have existed for centuries, but have proliferated in recent years, in large part, because of...(you guessed it!)...the deregulation of the industry. In 2000 US Congress passed the Commodity Futures Modernization Act (CFMA), which loosened regulation on derivatives and opened the floodgates to speculators.

Derivatives represent a kind of synthetic, disassociated economic “value.” There is nothing inherently wrong with making bets on the future — derivatives can be useful for hedging risk in some circumstances, but they are also ripe for speculation. It was complex derivatives that brought down the global economy in 2008, which were so abstract and interconnected that most people (even the institutional investors trading them) didn't fully understand them.

The value of the derivatives market is difficult to estimate because people disagree on how to measure the market. But some estimates put it at $1 quadrillion USD (that is, 1 with 15 zeros), which would amount to around $128,000 of derivative contracts for every single person on the planet. Others believe the market is 10 times that amount of global GDP (gross domestic product) — $847 trillion USD.

However you slice it, synthetic financial instruments — constructed by humans as abstractions of some other underlying value — now arguably represent more 'economic value' than entire sectors of the global economy. If synthetic bets can make traders real money, and synthetic life can come to 'life,' could we not create new arrangements of economic value based on entirely different coding?

Hallmarks of Economic Value

Similar to different scientific schools of thought and their assertions about what "hallmarks" constitute life, varying economic schools of thought — and market participants — differ in how they conceptualize economic value.

But economic value is nothing more than what we collectively agree has value. Our financial and economic systems demonstrate that our ideologies and our ways of measuring value have evolved and changed over time, just like our scientific understanding of what it means to be alive. Although, perhaps searching for precise theories and measurements of economic value distracts from a more important question: how do we want economic value to serve human and ecological needs? How could it serve our collective flourishing?

When we speak of the economy, we often speak of a range of aggregate measurements (GDP, inflation, S&P 500 index value, etc.) which only loosely represent economic value and do not, in many ways, represent the things most valuable to human beings: care, joy, health, self-determination, etc.

Today, the things which capture the most economic value are increasingly synthetic and a result of financial manipulation and concentrated power. If price, market capitalization, and financial instruments (like derivatives) are only partially representative of economic value, and in some cases oriented towards the destruction of human and biological life, what should the new "hallmarks" of economic value be?

Can we envision a world where projects, firms, and institutions which support and sustain life (both human and biological) are seen as the most economically valuable? Where systems which widely disperse capital, instead of aggregating it, are the primary instruments of value's flow? Could finance facilitate businesses which provide needed goods and services to humans and the planet, instead of subsidizing the acquisition of market power? Could investors re-orient their incentive structures away from asset value maximization? Could a forest print its own currency? Could care work be added to GDP and that money be gifted back to citizens?*

Similar to Schrödinger's famous question, "what is life?" I believe one of the most pressing questions of our time is "what is economic value, and how might it reshape the world?" Let us take up this inquiry in earnest together.

*These last two ideas are from Indy Johar, founder of Dark Matter Labs who you'll hear from soon in an interview for this newsletter.