Paradigms Create Worlds — A New Foundation for Economics

This week, I discuss a new paper co-authored by Dennis J. Snower, an economist, and David Sloan Wilson, an evolutionary biologist: “Rethinking the Theoretical Foundation of Economics I: A Multi-level Paradigm.” The paper is 98 pages, and is fascinating. I’ll only cover the first half in detail today. Any misinterpretations or misrepresentations of their work are...of course my fault!

Also, I want to tell you about a few fun things:

- Do you know a policy wizard/wizardess with a big vision to make economies more equitable? Please help spread the word and recommend applicants for Common Future's new Policy Incubator! Applications due April 29, up to 75k in funding, must be US-based.

- Michelle Meagher and I are releasing a new paper in two weeks on how the Stakeholder Capitalism and Anti-monopoly movements/communities need to intersect more. I'll be presenting the findings from our paper (as Michelle is heading out on leave) at a Preventable Surprises event on April 27, 8am PT / 11am ET – you can register here.

• More context: Firms championed by the stakeholder capitalism movement, like Alphabet and Bank of America, are also among the worst antitrust offenders! So why this disconnect between stakeholder capitalists and anti-monopolists? While both movements have gained traction in recent years, the two communities and conversations rarely intersect. Both, however, ask fundamental questions about the nature and obligations of firms in society. Stakeholder capitalism generally focuses on what happens inside corporations, while anti-monopoly focuses on what happens between corporations, in markets and economies. These terrains overlap in important ways and, when seen this way, the potential congruence between the movements becomes clearer. - Robert Breedlove and I had a two hour meandering conversation, and while I am not a "freedom maximalist," I really enjoyed it and learned quite a bit.

Phew! Now onto the good stuff!

"Democracy and capitalism aren’t tangible things with an existence of their own. They are what you get when people within particular societies observe particular norms and adhere to particular values. They function differently at different times and can vanish into nothing if people, for one reason or another, stop behaving in ways which support them...The inability to conceive of a world and a solution to its big problems in which values matter, despite a wealth of historical evidence that values have often made all the difference, is the crisis of liberalism." — Ryan Avent

Paradigms create worlds

Take a moment to envision the skyline of your city (or of a major global city). Which buildings do you see? Likely, it is some combination of luxury, high-rise condominiums, and the office towers of powerful financial firms like banks and investment shops. Perhaps in recent years, technology firms have taken over, as they have in Seattle (where I live). As my friend Katrine Marçal has pointed out, this was not always the case.

Take the city of London, for example. The skyline used to be dominated by religious buildings — the steeples of churches rose higher than any other structures — because they represented the economy of the time. Churches had immense wealth and power. Even up until the early 1960s, St. Paul’s Cathedral was the tallest building in London. But, in the 19th and 20th centuries London’s steeples gave way to government buildings like the Elizabeth Tower (Big Ben), which represented the new seat of government power.

Today, of course, the skyline of London is dominated by banks, commercial office towers, and residential condos — including iconic buildings like the Shard, the Gherkin, and the car-melting Walkie Talkie. All of these buildings are the embodiment of, the great monuments to, the economic values of the times in which they were built.

In this and other similar ways, values physically manifest around us. Paradigms become embodied in the physical substrate of our world. They quite literally scaffold our reality.

Paradigms create worlds.

These worlds can serve our needs and elevate our humanity, or they can constrain and weaken it.

The authors of the new piece Rethinking the Theoretical Foundation of Economics I: A Multi-level Paradigm, talk about the stickiness of paradigms and the difficulty we have in moving beyond them once they are firmly embedded. They paraphrase Thomas Kuhn, a philosopher, by saying "a paradigm is an internally coherent system of thought that results in useful insights but also finds it difficult to escape its own assumptions."

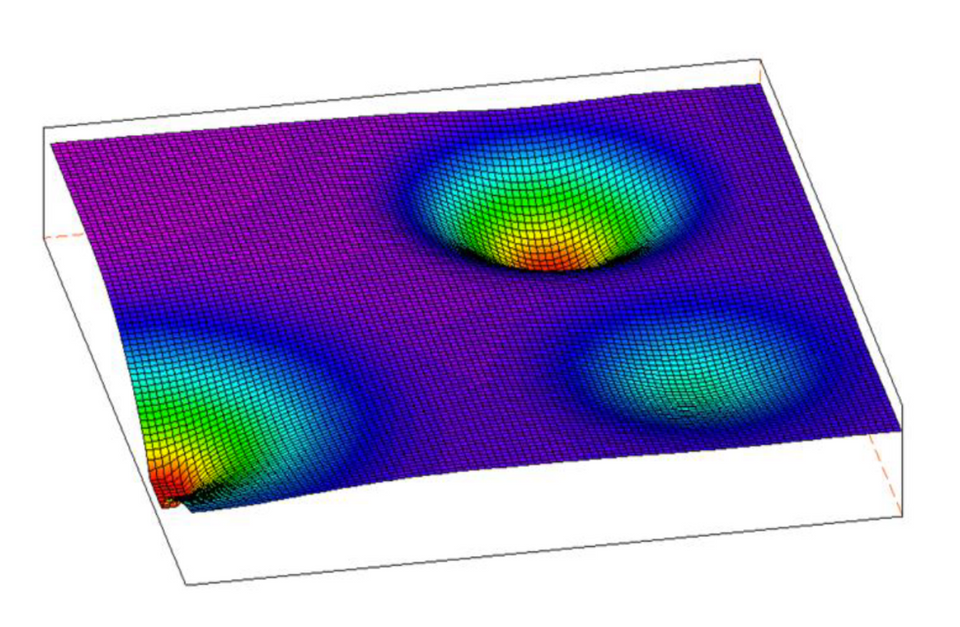

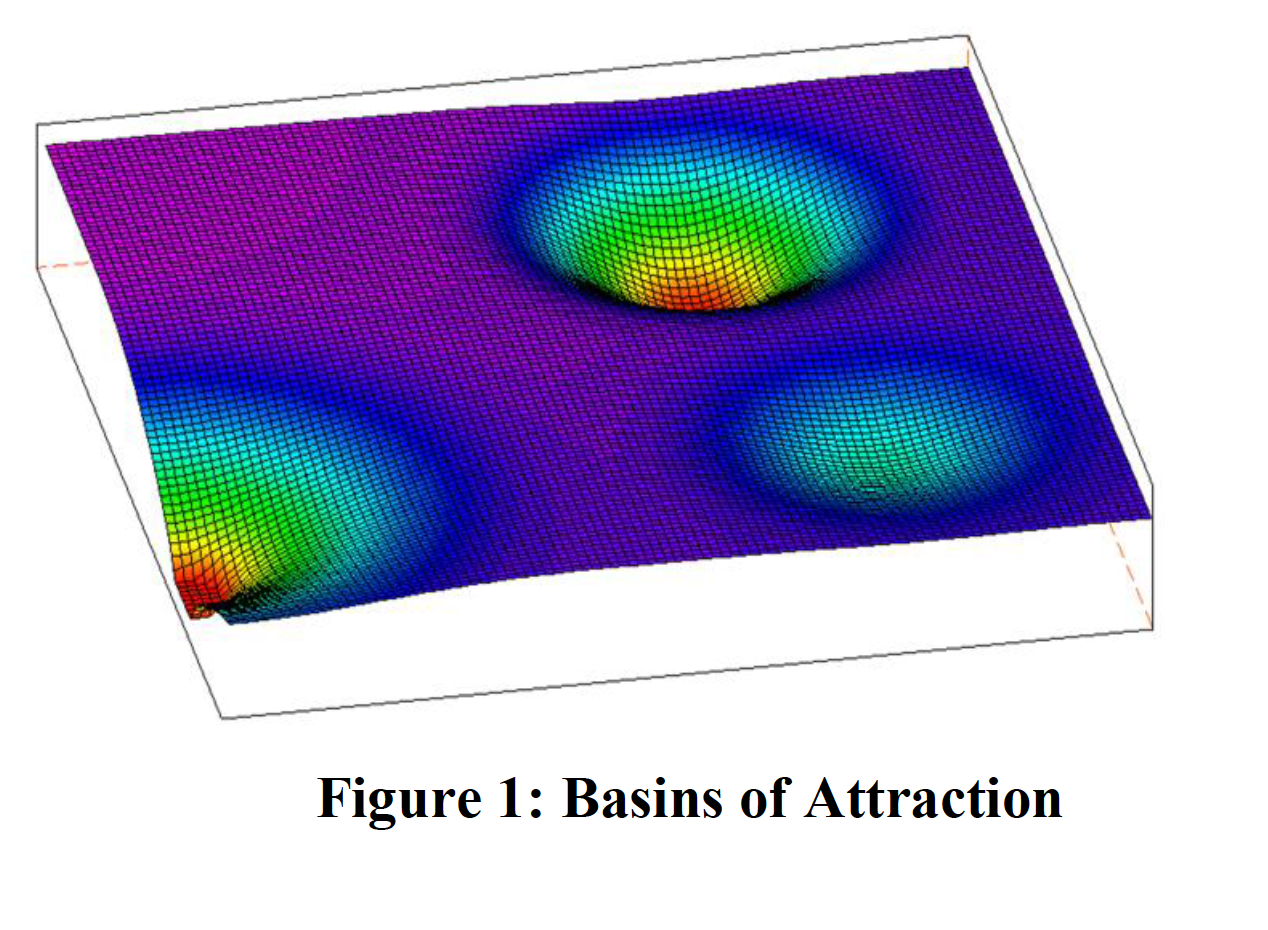

Using the mathematical term “basins of attraction”, the authors claim that paradigms – similar to biological and human ecosystems — are like a ball which rolls to the bottom of a basin. Once a paradigm has settled into this ‘equilibrium state,’ it can be very difficult to roll the ball up the steep sociocultural hill to find a new basin of attraction (where the ball — representing our collective consciousness — will roll to the bottom of another basin). Complex systems, like economies and natural systems, also have multiple local equilibrium states, rather than a single global equilibrium. This is what the image below visualizes:

In many ways, these paradigm basins are dug even deeper by modern technology. Ben Hunt has published a 3-part essay series on paradigms and webs of human thoughts as living realities, mediated through the technological and cultural structures of “Big Tech, Big Media, and Big Politics.”

We now have an entire ecosystem of actors who can monetize Big Stories (paradigms) and weaponize them to steal our attention, keep us 'engaged' and to direct our behavior in certain ways. Perhaps this is why the great systems theorist, Donella Meadows, identified paradigms (and transcending our own sets of beliefs — rolling our thinking ball into another basin, and then another) as the highest leverage point for systems change.

Economic Theory's Current Resting State

Orthodox economic thinking has settled into the bottom of a basin for the last two hundred years or so – and this has affected economic policy-making, economic imagination, and the flow of finance in significant ways.

At the center of that basin is the bounded, autonomous, rational man — disconnected from natural and social systems — and maximalist to his own desires. This Vitruvian-type man is the central figure in economics.

Economics started with this man as the one locus, or unit of economic creation, and built an entire discipline from that locus. (And it is not surprising that this theory was created and promulgated by highly educated, wealthy, white males, who were not in any way representative of the whole of human experience). This elevated an individualistic worldview over an interconnected, multi-layered one.

Wilson and Snower put it this way: “Individualism comes in many varieties, but all of them privilege the individual organism as a fundamental unit of analysis and attempt to reduce all things social to the thoughts and actions of individuals. In economics, this manifested as the rational actor model of neoclassical economics and the treatment of supra individual entities such as households, firms, and states, as if they are rational individuals.”

Not only was the rational individual the unit of analysis, but it was theorized that maximizing the individual's self-interest was the best way to organize society and markets at large — the best way to create collective benefit. Despite wanting to present as a purely mathematical discipline, this was a highly sociological value judgment about the character of humans, and it was a misunderstanding of our evolutionary history.

The authors point out that it is true that self-serving behavior does reign supreme in situations of individual contest: one person against one person. Within small groups, it pays to undercut another person. But, when groups are in conflict with other groups, collaboration (not competition) is evolutionarily advantageous. Wilson references his earlier work with E.O. Wilson in this paper, and says: “Selfishness beats altruism within groups. Altruistic groups beat selfish groups. Everything else is commentary.”

Self-preservation works at small scales, but can be dangerous at larger scales. What is true for the individual, isn’t true for society. Or what is true for one part of a system, may not be true of the whole. This is known as the fallacy of composition. Just because you have a phenomenal singer in the choir, does not mean the choir will be phenomenal. What is true of the part, is not always true of the whole.

Another example is a bank run — if you think your bank is going bankrupt, you'll high-tail it to the bank to take your money out. Everyone else does the same, and the collective result is that you precipitate the bank going bankrupt — the very outcome you wanted to avoid. Or running for the door in a fire. If you’re a fast runner, maybe you get out, but if everyone rushes for the door at once, you end up jammed at the exit.

This means that we can't just look to individuals to understand complex systems, or base economic theory on the decisions of a sole, rational person – we have to understand that humans are embedded in social contexts. And what is true for an individual is not always true for the system at large.

Primacy of social relations

A key point that Wilson and Snower argue in their paper is that, when you look at the behavior or trait of something, you can’t view that trait in isolation. You have to analyze it at the level of the larger group, to understand why something evolved to have a particular function. For example, if you are an alien landing on earth and you discover a watch, you can analyze the functional value of the watch — telling time — but that wouldn’t help explain why the watch was made in the first place. For that, you would have to understand human society, our desire to coordinate our actions, to convey status, etc.

When trying to understand the economy, we cannot simply look at individual human behaviors — because they exist within a nested set of other relationships, and within the ecology. So although individual humans may exhibit competitive of self-preserving tendencies, when you look a level up — at our social groups — we exhibit more cooperation.

Indeed, it was our cooperation as a species which ultimately led to our outstanding evolutionary position. Cooperative social interaction actually changed our evolutionary path, and the way we cognate: "The human brain and body evolved to integrate both personal and social resources in making their myriad tradeoff decisions, such as what to remember, what to pay attention to, or how much energy to allocate to one’s immune system. Most of these tradeoff decisions take place beneath our conscious awareness, similar to the unconscious regulation of our breathing and heartbeats. It follows that to live as an isolated individual in modern times is one of the biggest evolutionary mismatches imaginable.”

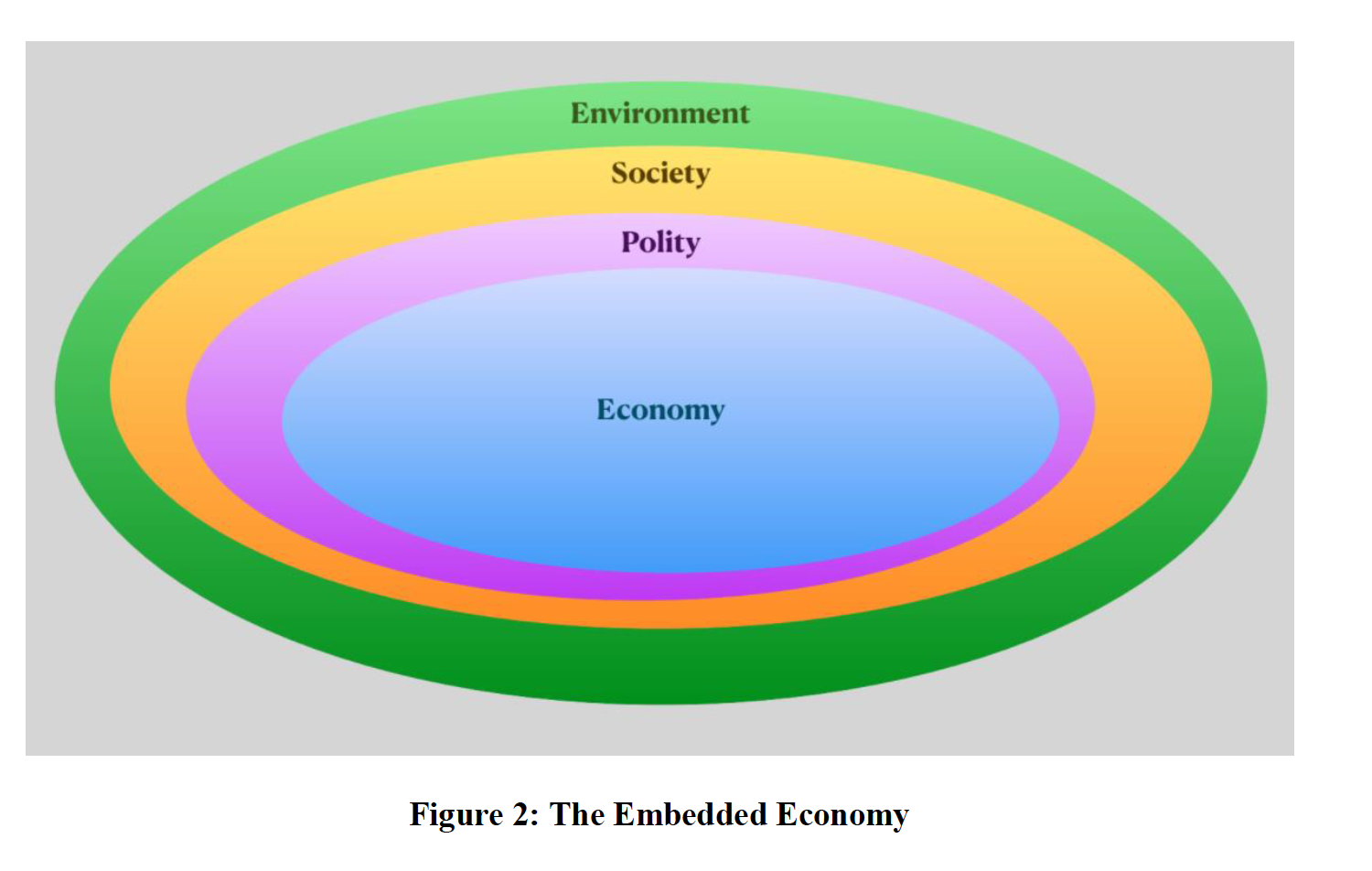

The authors summarize these points by saying that orthodox economics begins with the individual, but their new framework — multilevel selection theory — conceives of the human person as part of cooperative groupings. And those social groupings are foundational for the creation of the polity and the economy, all of which are nested within the environment (as shown in Figure 2).

The authors are trying to show that the economy is "embedded within other domains of living interactions" and therefore, should serve a higher purpose than its own perpetual expansion:

"We propose that economics be defined as the discipline that explores how resources, goods and services can be mobilized in the pursuit of wellbeing in thriving societies, now and in the future. Since we are social creatures, our wellbeing must be understood in the context of thriving societies. Though some human needs and purposes are individualistic (relevant only to the individual in isolation from other individuals), most are collective (relevant to the individual with reference to the individual’s place within social groups). Care, belonging, status-seeking, exercise of power, and much of achievement are objectives that are inherently social. This means that the individual’s decisions cannot be understood independently of the individual’s position within social networks."

Just like the watch example, we can't understand ourselves outside of our relationships with others. There is no individualism, without community.

The authors propose moving the fundamental 'basin of attraction' / paradigm of economic theory from the Vitruvian man and his selfish impulses, to a more rich, layered, and holistic understanding of humans in complex webs of relationships, social structures, and our ecology. As Mary Oliver once wrote, "Do you think there is anything not attached by its unbreakable cord to everything else?"

What seems intuitive to many of us — that we are fundamentally interconnected with the cosmos and one another — is, unfortunately, still barely a consideration in modern economic theory. But thankfully, it appears, that this is about to change. Economics needs a new paradigm, a new big story, and a new basin of attraction that will scaffold our future worlds.

How might this new embedded, multi-layered, and cooperative notion of humans change economics? How might it manifest in our systems? What new skylines might it produce in the future? What new imaginative opportunities might it open? How might our values influence how we understand and account for economic value in the future? That's largely up to us.

As Donella Meadows once said:

"The future can’t be predicted, but it can be envisioned and brought lovingly into being. Systems can’t be controlled, but they can be designed and redesigned...We can’t impose our will upon a system. We can listen to what the system tells us, and discover how its properties and our values can work together to bring forth something much better than could ever be produced by our will alone. We can’t control systems or figure them out. But we can dance with them!”