What Economists can Learn from Starlings

What can starlings, consciousness, and mimetic desire teach economists?

Happy New Year!

This week, while driving over gritty downtown Seattle streets, a vision greeted me from above: I saw in the distance a swarm of birds – piercing the sky in a mesmerizing, shape-shifting pattern. As I drove towards this swirling ecological marvel, I was miraculously positioned right underneath it by a stoplight. As I waited, the birds circled directly overhead as I strained to watch them through my side, front, roof — side, front, roof windows.

And I knew I had to write my first post of the year on emergence. Today we cover:

- Starlings, ant colonies, and consciousness

- Complexity economics

- Mimetic desire

This means, I’m interrupting the Profit series for a moment. I gave myself the present of permission this year — and, in part, that means permission to write about the things I’m most excited about. So who knows when Profit will resume…but I'm sure its time will come.

Oh, and if a friend forwarded you this post, you can subscribe here.

“Complexity economics sees the economy not as mechanistic, static, timeless and perfect but as organic, always creating itself, alive and full of messy vitality.”

— W. Brian Arthur

Starlings, ant colonies, and consciousness

Starlings are birds found in nearly all regions of the world (though are considered an invasive species in North America). They form wild, undulating shapes called murmurations which are a form of swarm behavior — a complex collective behavior arising from individual actions. Complex collective action without centralized control is also seen in ant and honeybee colonies. And these forms of animal behavior all share something in common: they exhibit properties of emergence.

Emergence, a term from complexity science, is all around us. Bodies, families, democracy, markets, forests, and many other phenomena display emergent properties — they exhibit properties unique in combination that their individual component elements don’t have in isolation.

Human consciousness is another example. Consciousness is not simply the sum of the physical component parts of the brain: neurons, synapses, brain stem, etc. If you threw all those things together in a corner, you wouldn’t expect consciousness to arise. Consciousness only arises from the combinations and synergies of its component parts which form layers of new structures which re-combine to scaffold new combinations, and so on. These combinations of combinations ultimately emerge an entirely unexpected and non-mathematically calculable outcome: consciousness.

Emergent phenomena are non-linear, self-organizing, and they evolve in an open-ended way (meaning, we cannot predict what will emerge from the component parts). Physicists trying to understand how life forms describe life this way, saying things like “biology is the next frontier of physics.” I (and many others) would argue it is the next frontier of economics, as well.

Without getting too technical in this post, there is both ‘strong’ emergence and ‘weak’ emergence. Flocking starlings are an example of weak emergence in that we have actually figured out the mathematical rules which govern this behavior: 1. The birds align their movement with the 6-7 birds surrounding them 2. They keep enough distance to not crash into each other and 3. They remain close to their neighbors (presumably to align their flight pattern with neighboring birds).

To truly understand the behavior of swarms, we could not simply analyze the individual behavior of one bird. Neither could we add up the motion of each individual bird to understand the flock in aggregate. Instead, we would need to look at both the individual birds, how they interact with each other, the patterns they form, the final outcome of murmuration, and how that feeds back to each individual bird's behavior. This is how we can begin to understand emergence.

Complexity economics

Similarly in economics, we cannot understand the economy by only analyzing the behavior of individuals (as behavioral economics has emphasized) or by adding up its component parts in aggregates (like GDP or other Keynesian methods). We need to understand the economy as a complex, emergent system which is constantly shifting – like a murmuration.

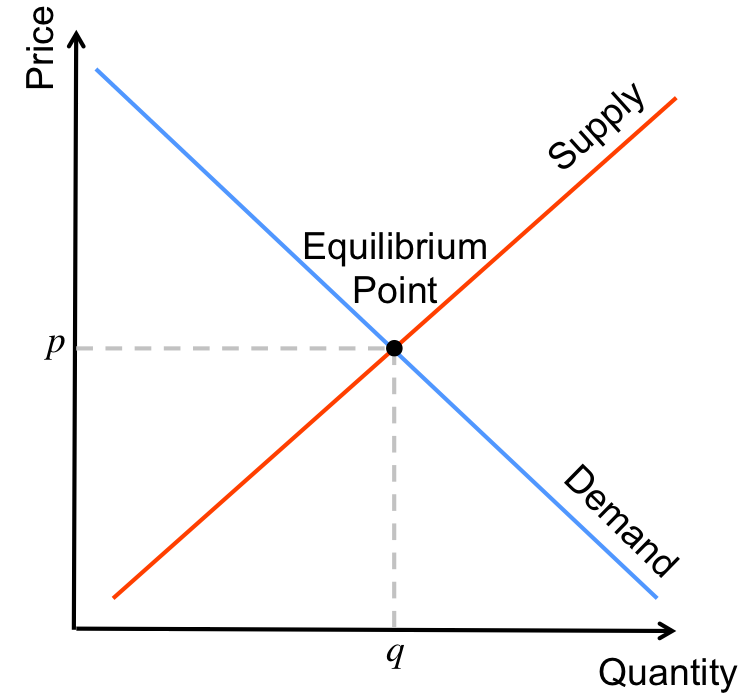

We are taught that markets can reach a state of natural equilibrium – supply and demand. But this kind of general equilibrium does not exist in emergent systems.

And this is one of the biggest disconnects in how we understand the economy today. Many economists still function in a world of reductionist cause and effect, and linear models or measurement tools. For example, "if we pump money into the economy by central banks, it will cause inflation." In other words: If we do X, we get Y. To be fair, many economists don’t think the world actually functions this way, they use reductionism because it simplifies analysis and helps with mathematical calculations.

But the reason this rarely works, is because economic systems are emergent — it's difficult to take an action which yields a linear outcome of our choosing. There is no central command center for the economy – we all create it together, as it creates us, in an emergent loop. And as of now, we don’t have sophisticated enough tools, or computational power, to measure and model this across the entire economy. We can only begin to understand it via triangulation.

However, an increasing number of heterodox (unorthodox) economists are trying to do just this in a field now known as complexity economics. A pioneer of complexity science and recipient of the Schumpeter Prize in economics — W. Brian Arthur — said this in a recent paper:

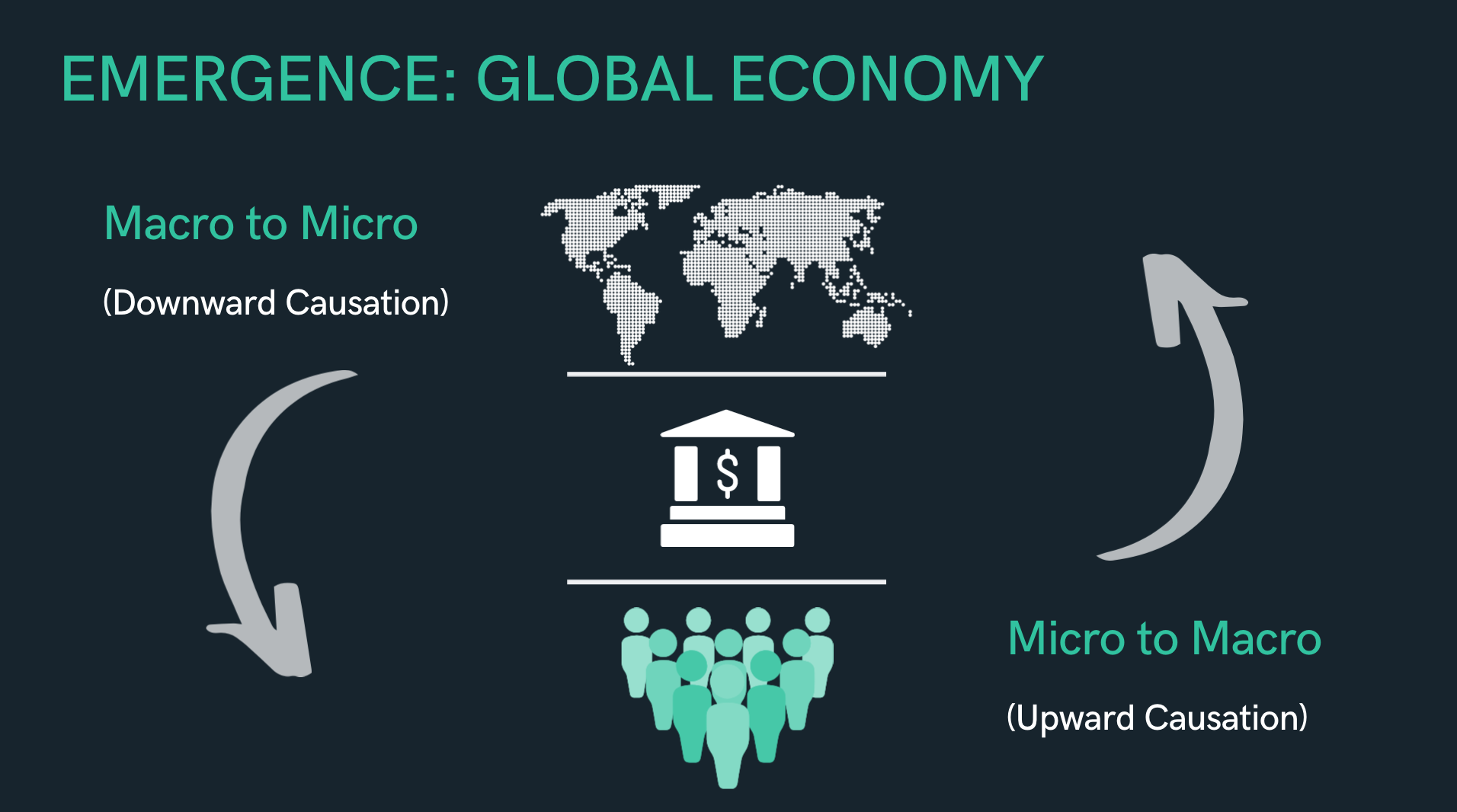

“Complexity economics sees the economy — or the parts of it that interest us — as not necessarily in equilibrium, its decision makers (or agents) as not super-rational, the problems they face as not necessarily well-defined and the economy not as a perfectly humming machine but as an ever-changing ecology of beliefs, organizing principles and behaviours. The approach, which has now spread throughout the economics profession, got its start largely at the Santa Fe Institute (SFI) in the late 1980s. But the basic ideas of complexity economics have an even longer history in economics. Even before Adam Smith, economists noted that aggregate outcomes in the economy, such as patterns of trade, market prices and quantities of goods produced and consumed, form from individual behaviour, and individual behaviour, in turn, reacts to these aggregate outcomes. There is a recursive loop. It is this recursive loop that makes the economy a complex system.”

Democracy is another helpful example – we elect leaders, create laws and structures which govern our behaviour (we exert upward causation on the system), and those laws and structures govern our behavior (there is downward causation from the system to our actions). Similarly with the global economy — we create agreements about money and value, create institutions to exchange, govern, and facilitate the flow of that 'value,' and what emerges is a hyper-networked and complex global economy. That economy then influences our behavior.

Mimetic desire

Emergence teaches us that we create patterns which in turn create, and pattern, us. And this applies to much of how our paradigms scaffold our systems of behavior.

How do we know what we want in life? The French philosopher René Girard said that we learn what we desire by imitating others: “Man is the creature who does not know what to desire, and he turns to others in order to make up his mind. We desire what others desire because we imitate their desires.” (h/t to my friend Stacey Fikes for reminding me of Girard's work).

In this way, desire is also an emergent phenomenon – we create cultural memes of success, of lust, of status. Objects are not inherently desirable, but we create collective cultural myths around their value and desirability. I discussed the example of the Louis Vuitton “Urban Satchel Bag” — a purse made of trash which sells for $150,000 in this post.

Money, fundamentally an abstraction of value, is perhaps the best example of an emergent mimetic desire — we create its value by collectively agreeing to it, which then governs our behavior and our desire to acquire it. Something we have fabricated as a species now exerts tremendous power over us in return. What other possibilities might we emerge together?

Once we understand emergence, we begin to see all of life — starlings, consciousness, democracy, the economy, mimetic desire, our family dynamics, and much more — through this fundamental pattern. And we must embrace these natural patterns and rhythms if we have any chance of co-creating new futures.

As one of my favorite systems theorists, Donella Meadows, has said:

"The future can’t be predicted, but it can be envisioned and brought lovingly into being. Systems can’t be controlled, but they can be designed and redesigned. We can’t surge forward with certainty into a world of no surprises, but we can expect surprises and learn from them and even profit from them. We can’t impose our will upon a system. We can listen to what the system tells us and discover how its properties and our values can work together to bring forth something much better than could ever be produced by our will alone. We can’t control systems or figure them out. But we can dance with them!"

And to end, here's a poem I wrote last year:

Starlings

Wild undulations like ghostly apparitions,

shape-shifting through daylight.

Each small actor, approximating their movements in relation to their neighbor

a proximity and collective intelligence we aspire to

fabricate in circuit boards filled with golden spools.

But they spin in golden hours, prismatic with possibility.

Their movement exhibiting emergence, as with our own consciousness.

Both phenomena that cannot be measured or modelled or moulded.

We spin, awake and asleep — dervishes of striving.

Notes

• For anyone interested in going deeper on emergence, I found this free online course from Systems Innovation incredibly helpful. It's how I first learned about emergence!

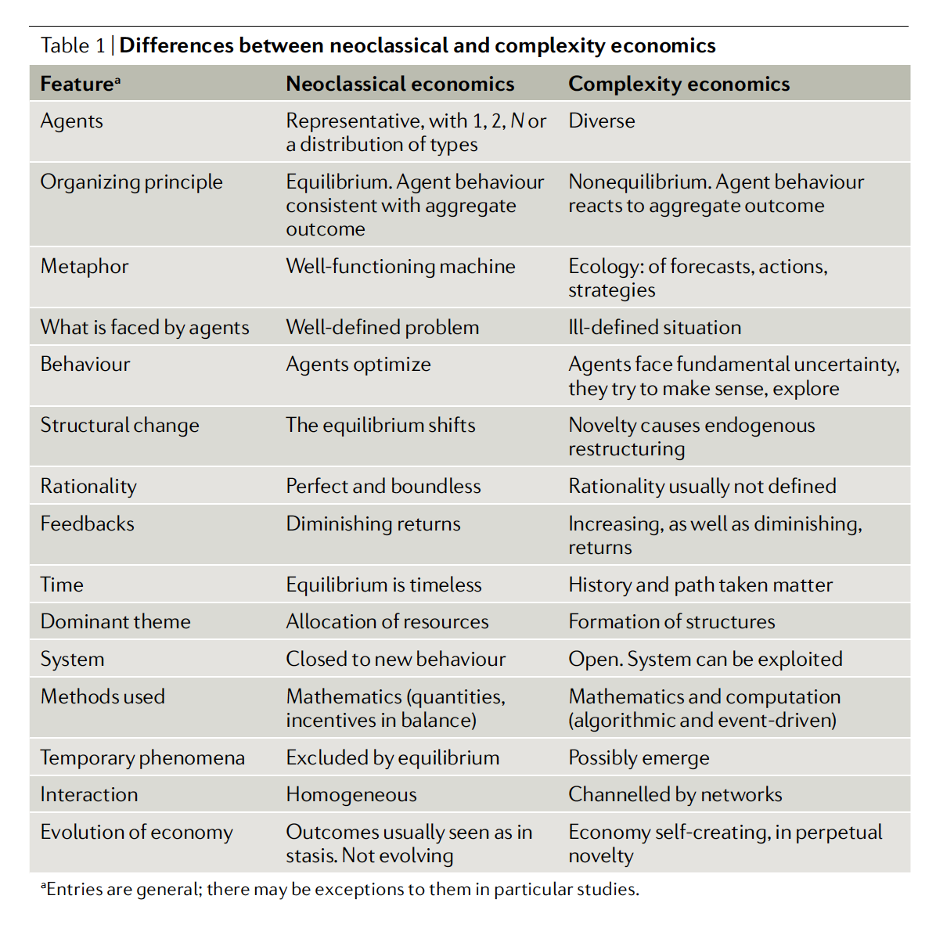

• Helpful table on neoclassical vs. complexity economics (for my fellow econ nerds out there) from W. Brian Arthur's paper I referenced above, Foundations of Complexity Economics: